Merchant Intelligence

SafetyKit's AI agents investigate what merchants actually sell, who they're connected to, and what they're trying to hide. Verify MCC codes, validate business licenses, and analyze products across websites, social media, and storefronts. Onboard high-risk merchants confidently without building an army of reviewers.

How Merchant Intelligence Works

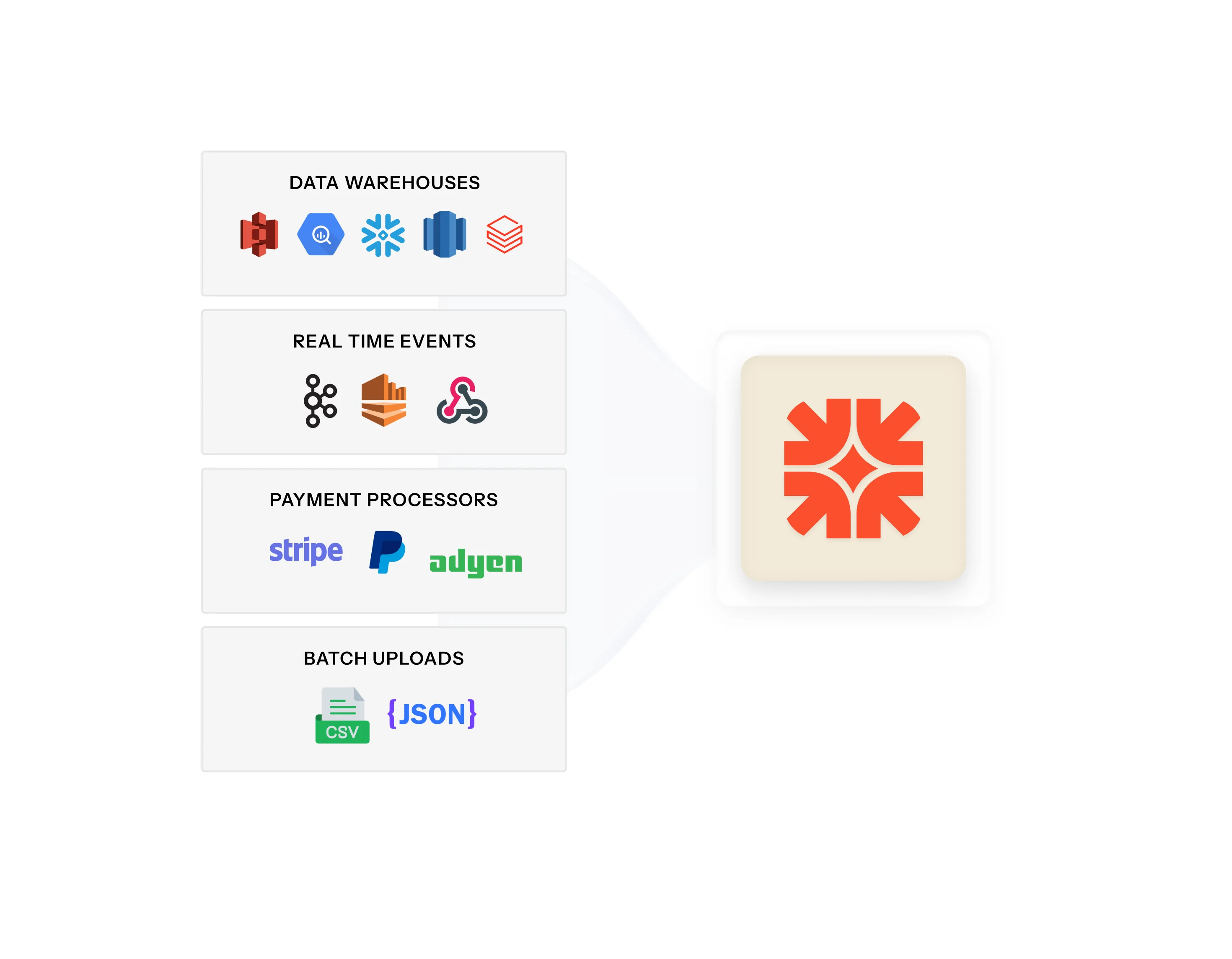

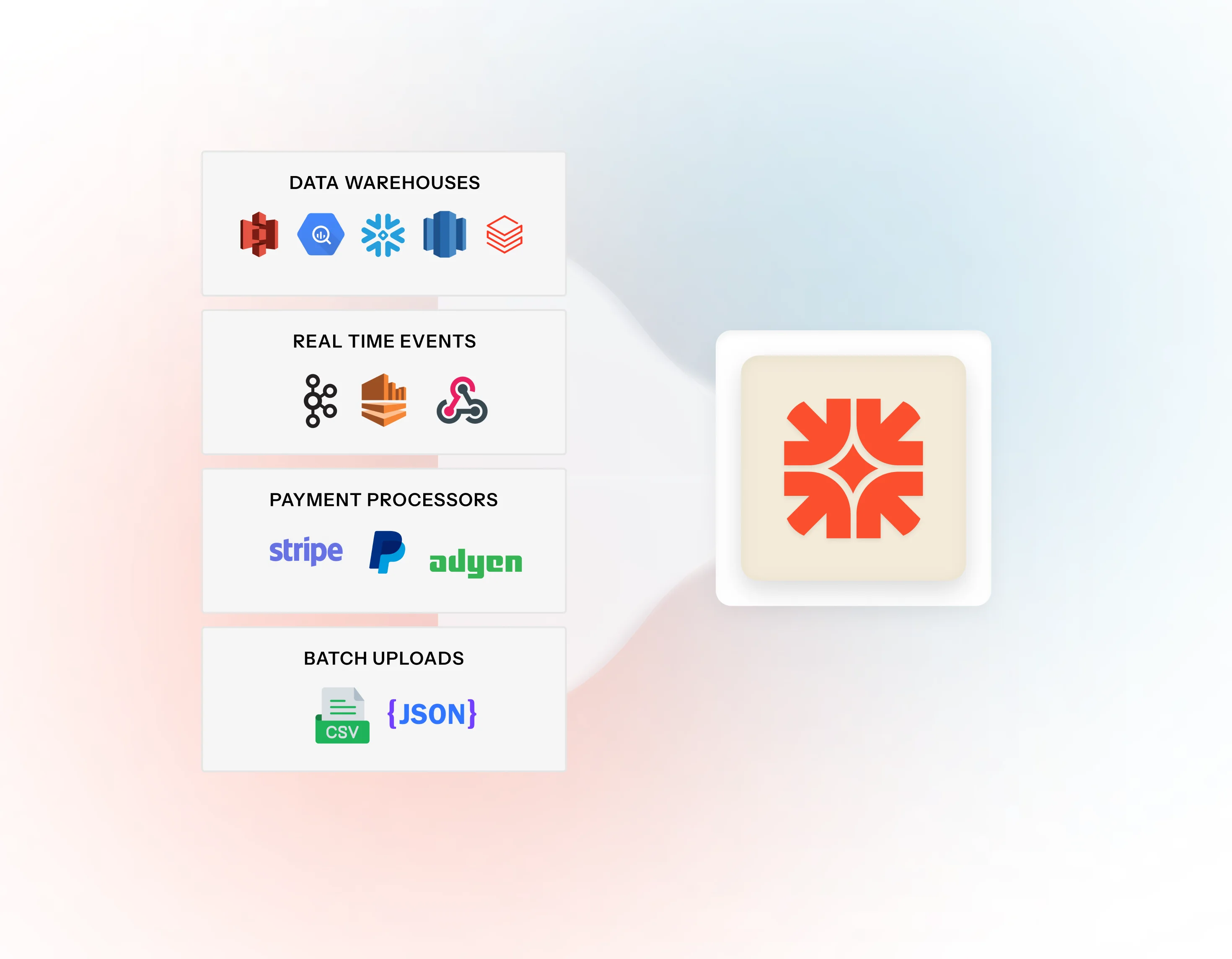

Connect your portfolio

Integrate your merchant data through API or batch feeds. Pull in onboarding records, MCC codes, business details, and existing risk signals.

- Real-time API integration for new merchant onboarding

- Batch feed support for existing portfolio analysis

- Connect to your existing merchant database without code changes

Configure investigation depth

Run high-level scans across your full portfolio or trigger deep investigations where risk signals appear. Set thresholds for automatic escalation.

- Tiered investigation levels based on risk signals

- Pre-built policies for card network violations and prohibited business types

- Custom rules for your specific portfolio risk tolerance

AI merchant investigation

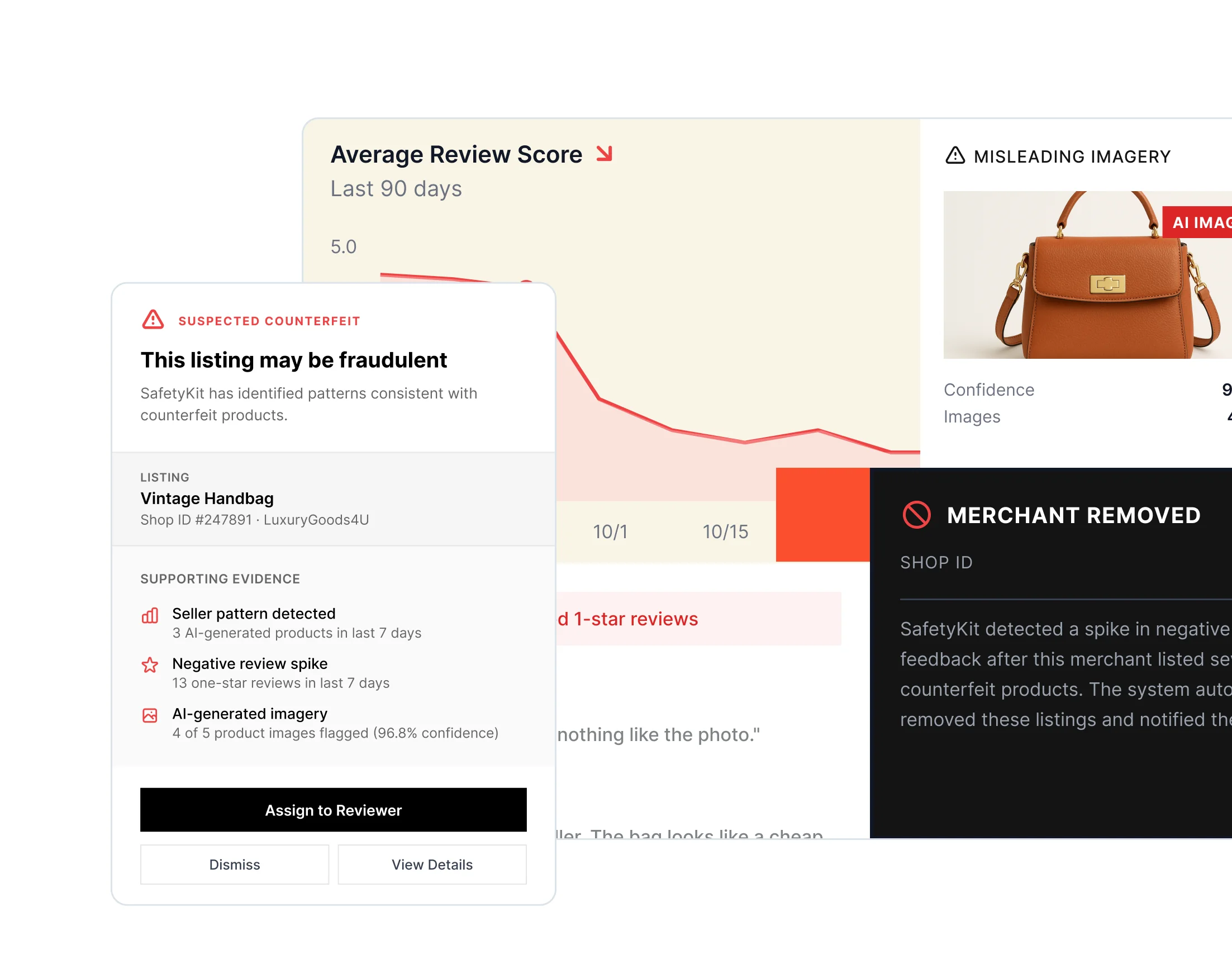

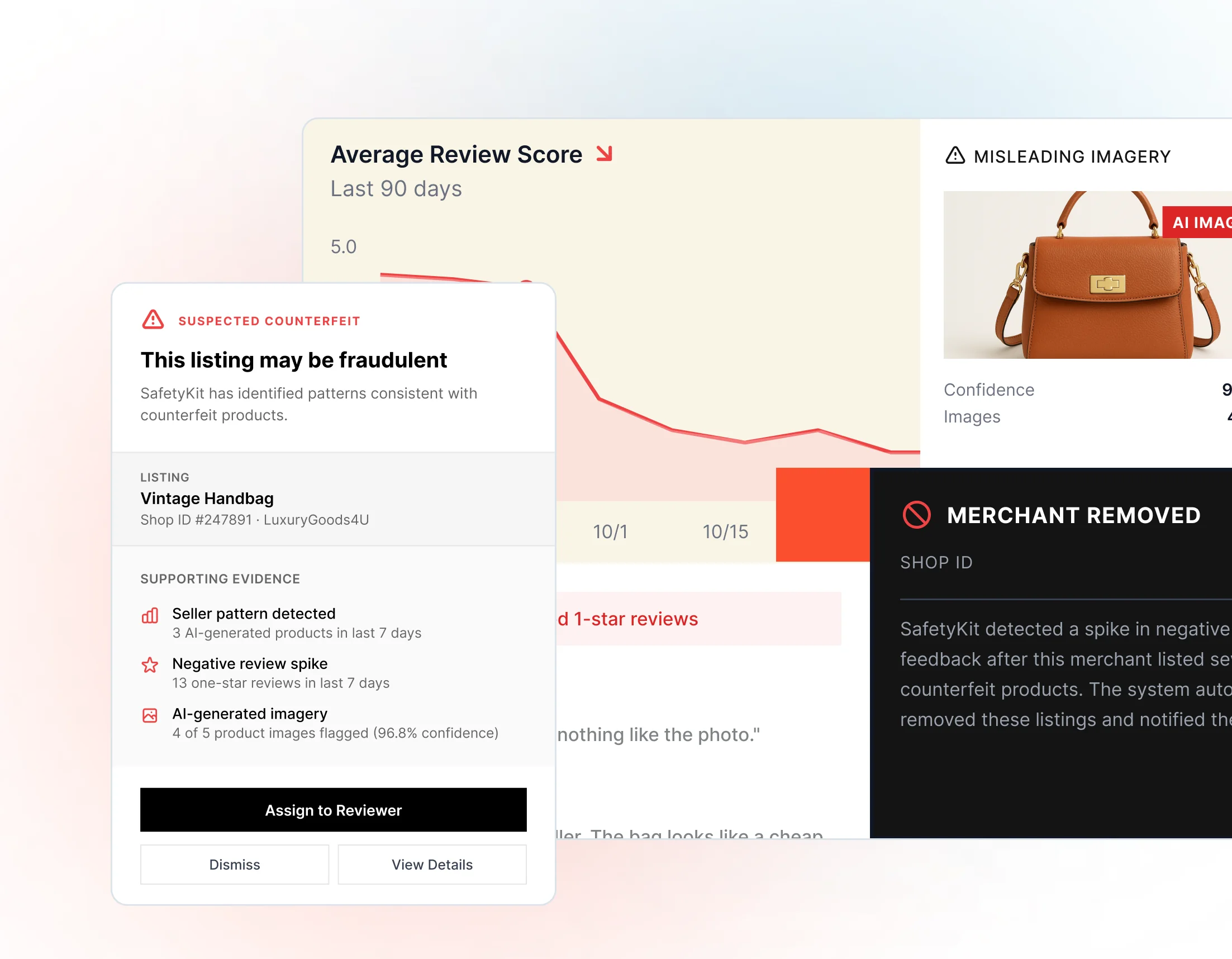

AI agents investigate what merchants actually sell across websites, social media, and storefronts. Surface MCC mismatches, undisclosed products, and connections to known bad actors.

- Deep investigation across websites, social media, and storefronts

- MCC and business license verification

- Connected entity and fraud network detection

Continuous monitoring

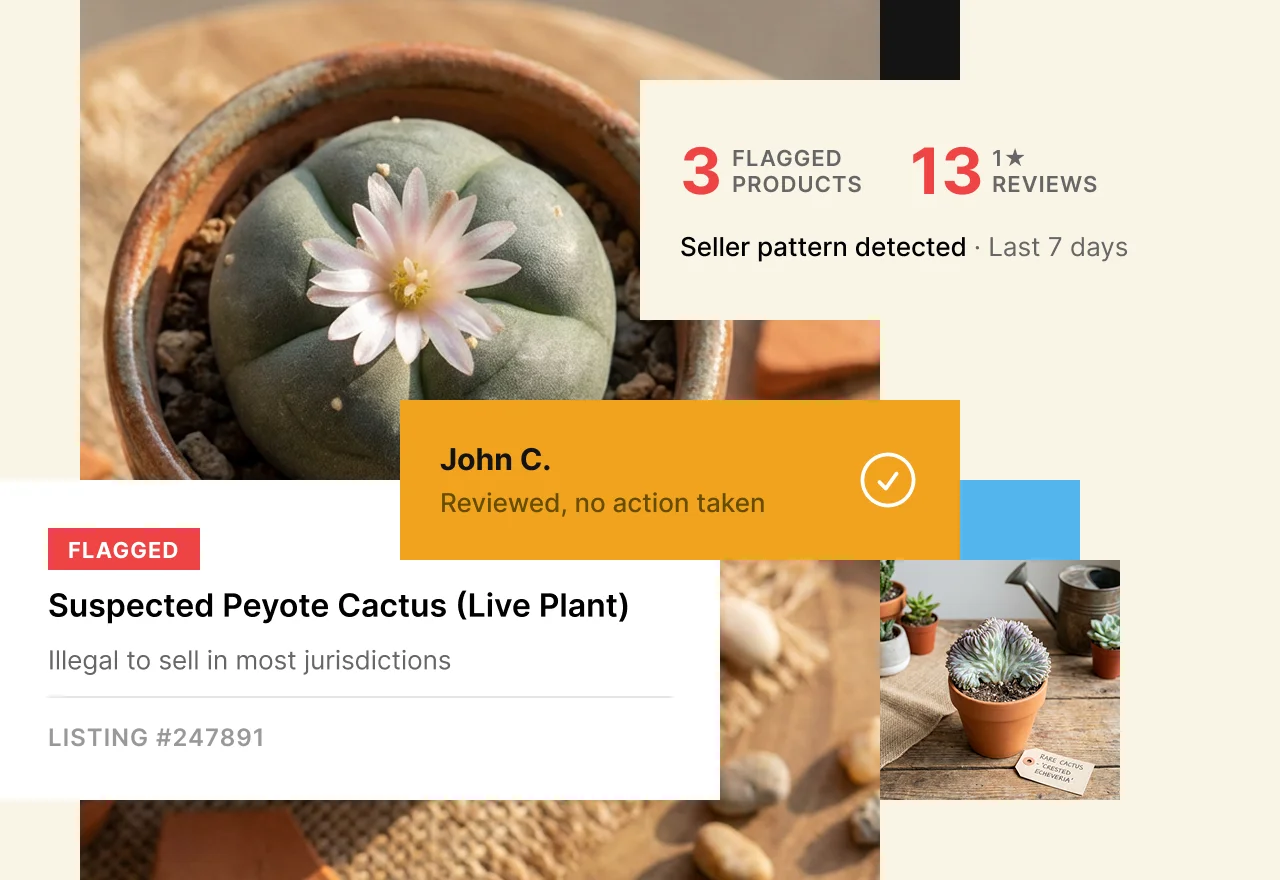

Ongoing monitoring catches merchant drift after onboarding. Reviewers handle escalations while the system learns from every decision.

- Ongoing portfolio monitoring for seller drift and new violations

- Reviewer console for high-risk and ambiguous cases

- Feedback loop that improves investigation accuracy over time

Merchant Intelligence

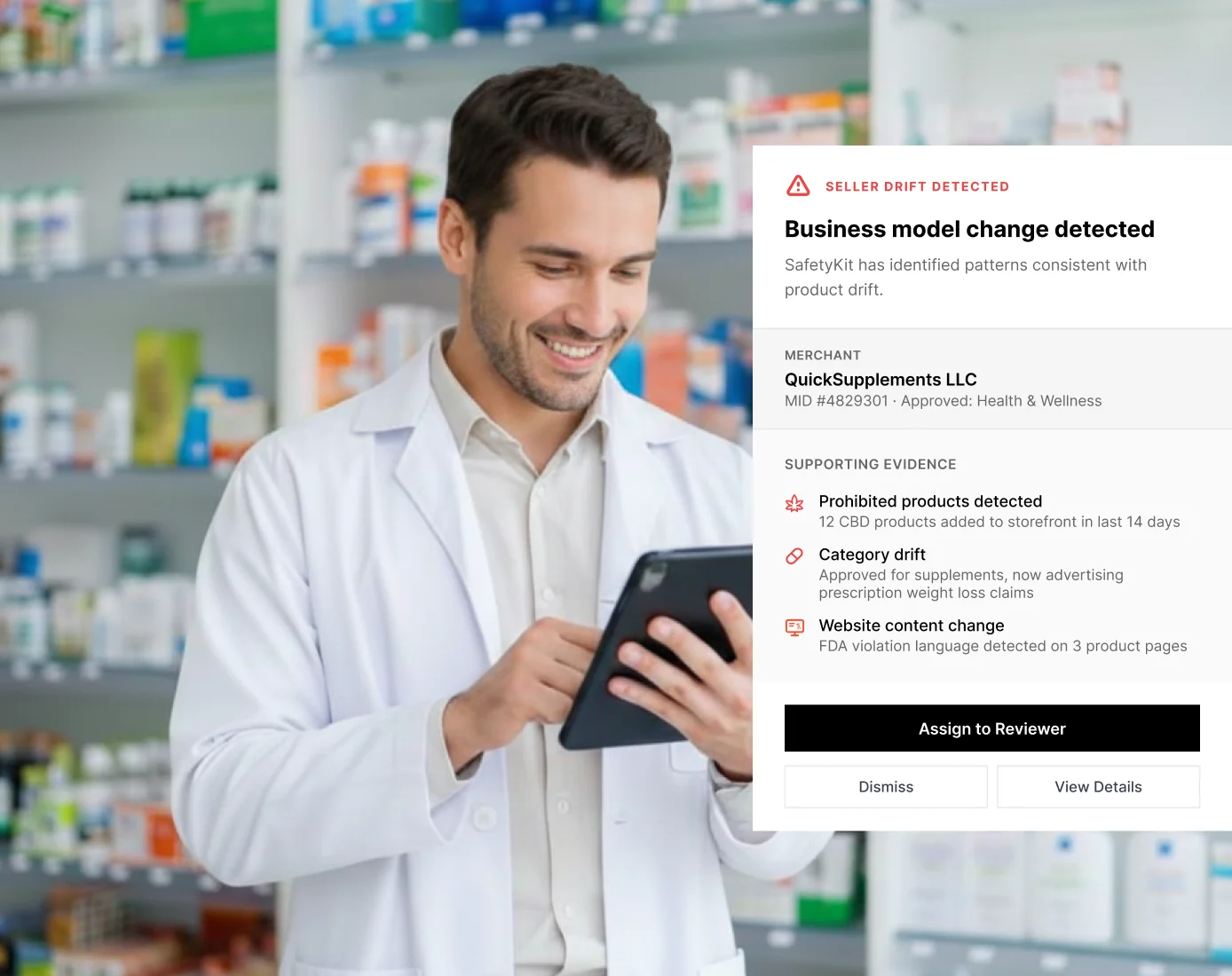

Deep Investigation

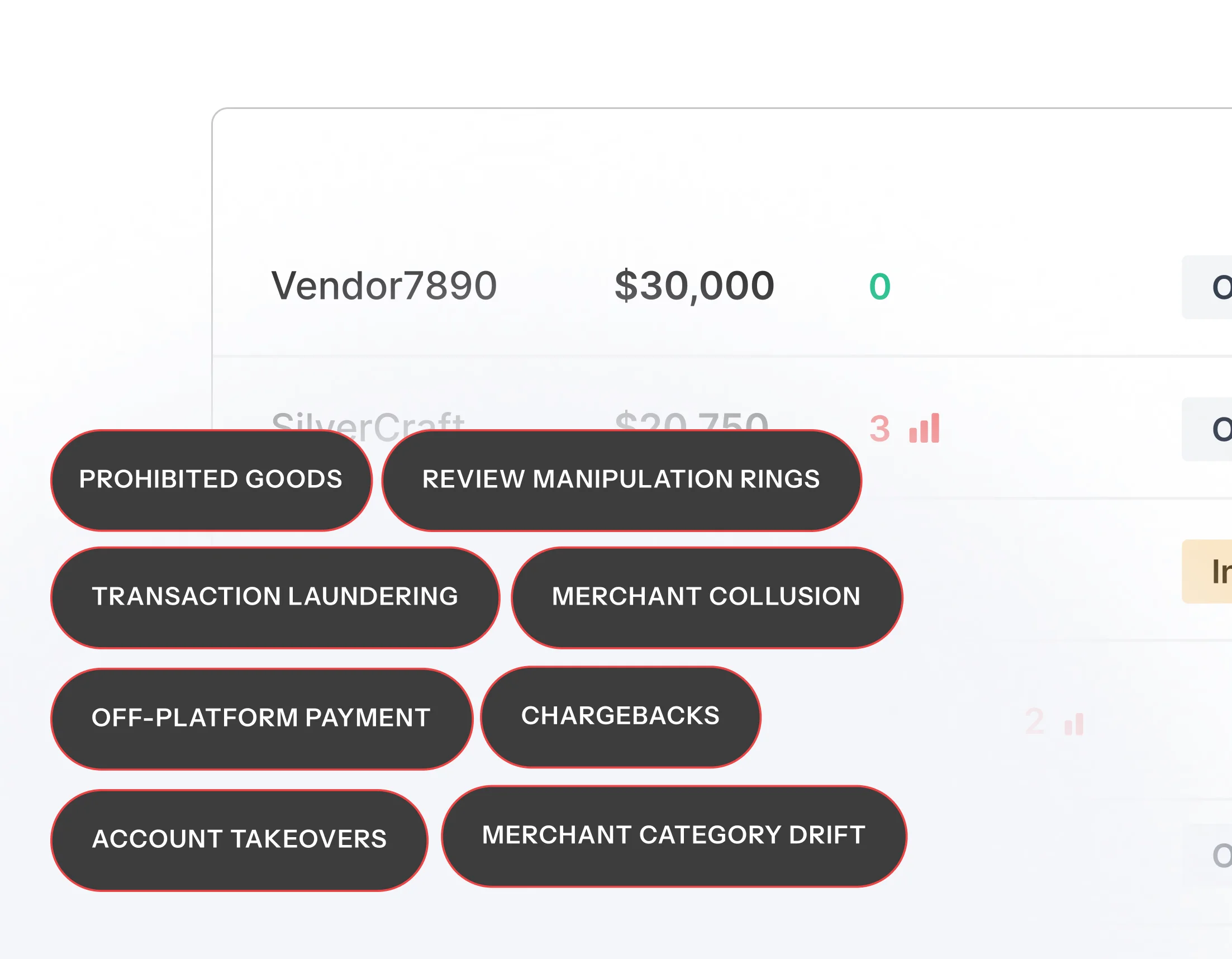

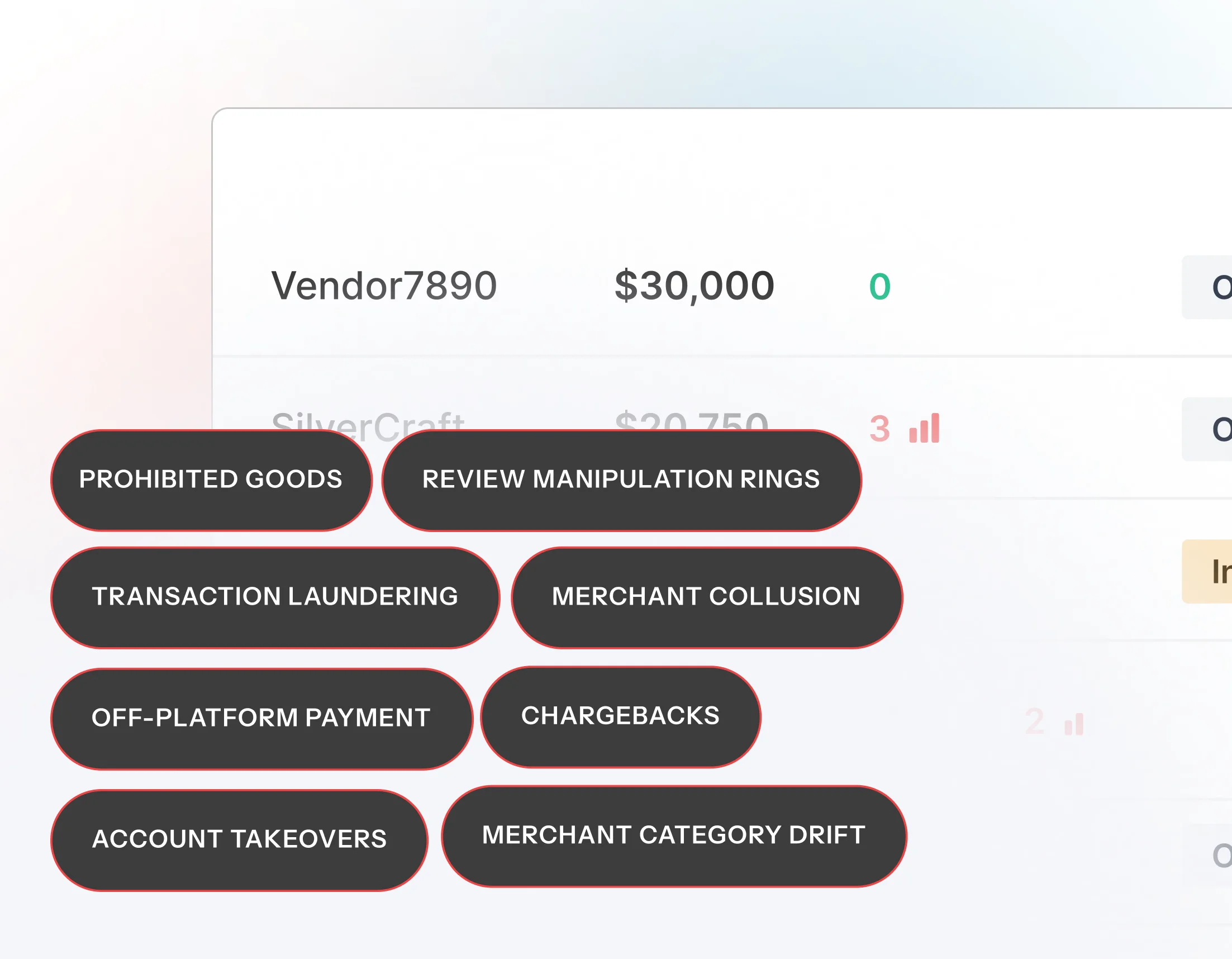

AI agents uncover what merchants try to hide, from undisclosed product lines to misrepresented business models. Surface violations that periodic audits and manual reviews miss.

Learn about Merchant Intelligence →MCC & License Verification

Verify that merchant category codes match what businesses actually sell. Validate business licenses and flag mismatches before they become card network violations.

High-Risk Expertise

Handle merchants that other systems can't. Our AI has deep policy knowledge around adult content, supplements, CBD, and other categories where the line between allowed and prohibited requires judgment.

Scalable Depth

Run high-level scans across millions of merchants, then increase investigation depth where risk signals appear. Get detailed analysis without reviewing every merchant manually.

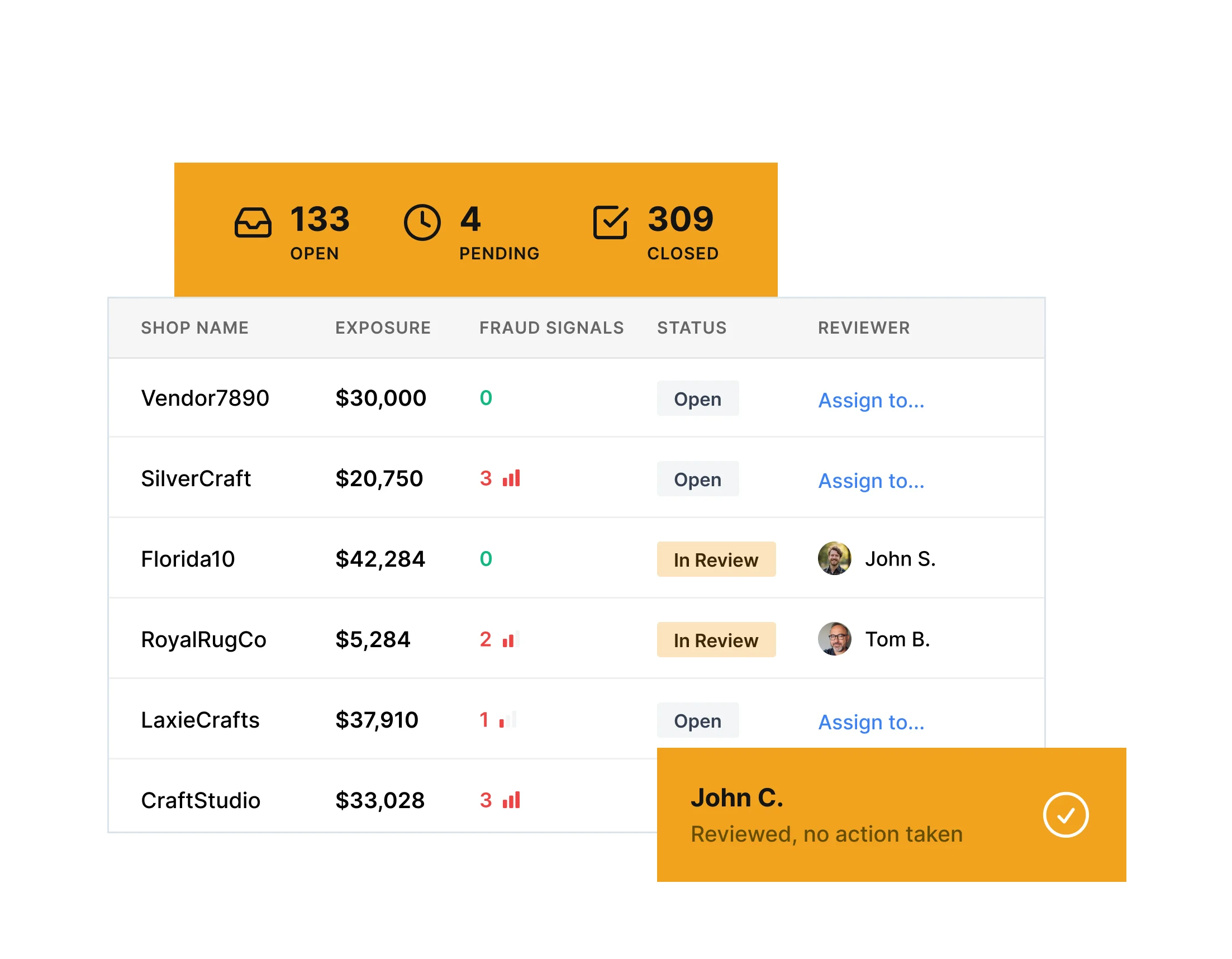

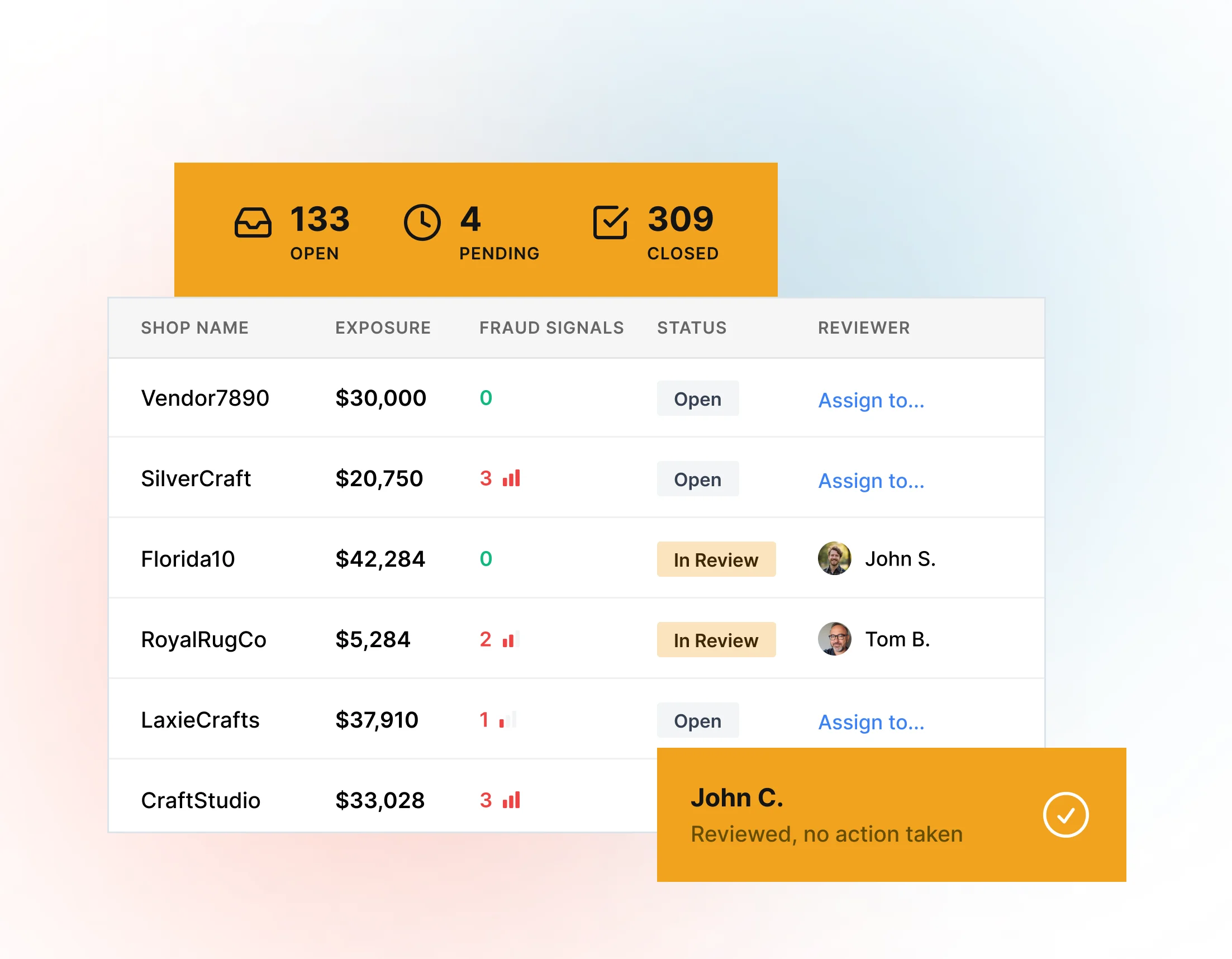

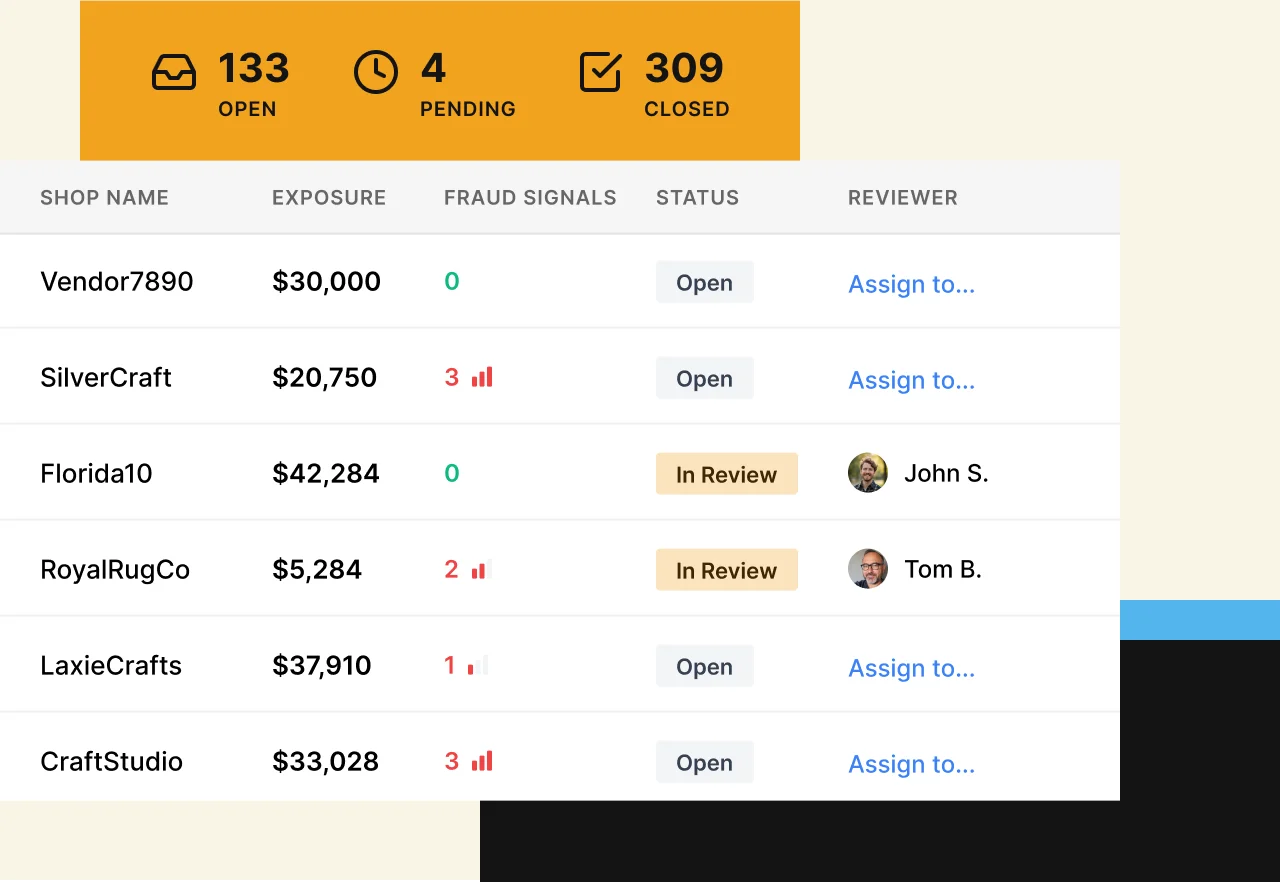

See network detection →AI-Powered Review Queue

AI agents make real decisions on edge cases, not just flag and route. Reviewers see full investigation results with merchant history, website evidence, and clear recommendations for cases that need human judgment.

Portfolio Risk Dashboard

See what your merchants are actually selling across their websites, social media, and storefronts. Surface MCC mismatches, undisclosed product lines, invalid business licenses, and connections to known bad actors across your entire portfolio.

Investigation Audit Trails

Every investigation and action is logged with full evidence. When card networks or regulators ask questions, pull complete documentation instead of reconstructing what happened.